Introduction

The UAE’s introduction of a corporate tax (CT) system has ushered in significant changes for businesses operating within the country. One of the key components of this new tax regime is the Corporate Tax Transition Provisions, which help companies adjust to the new rules while ensuring compliance. These provisions offer businesses a pathway to move from the pre-tax period to the first taxable period, including specific rules on asset recognition, opening balances, and adjustments. Understanding these transition provisions is crucial for businesses to avoid penalties and ensure smooth compliance with the new tax laws.

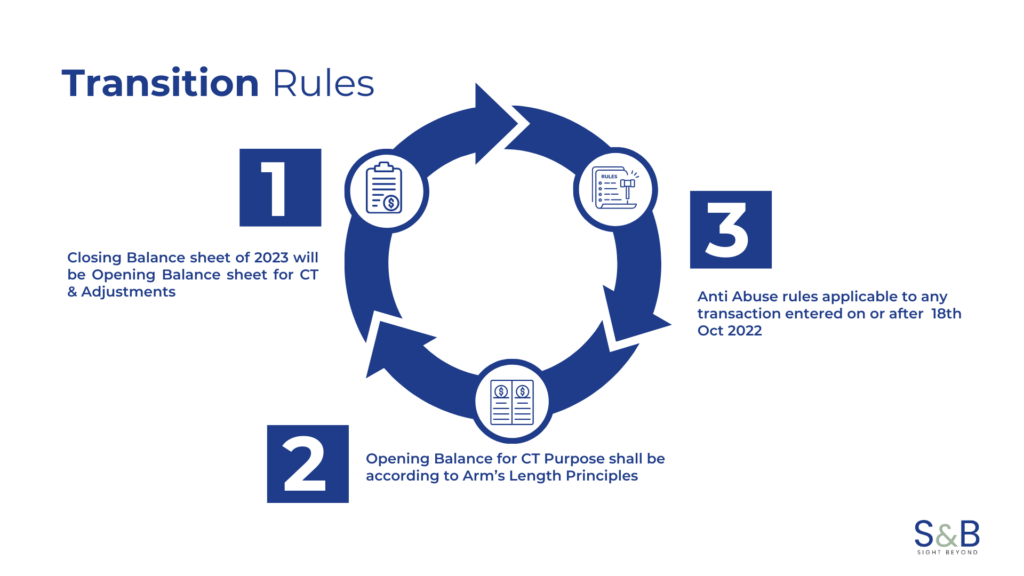

Key Transition Rules

A central feature of the UAE corporate tax transition provisions is the use of the closing balance sheet of 2023 as the basis for making opening balance adjustments for the first tax period. This means that businesses need to establish their tax position based on the final financial statements of 2023, which will then form the foundation for tax calculations moving forward.

Additionally, businesses are required to adhere to the Arm’s Length Principle when determining the opening balances. This means that intercompany transactions and valuations must be set at market value, reflecting what independent third parties would agree upon.A critical point to remember is the introduction of anti-abuse rules for transactions carried out after October 18, 2022. These rules are designed to prevent tax avoidance strategies that could exploit the transition provisions and may require businesses to justify the economic substance of certain transactions or restructuring efforts.

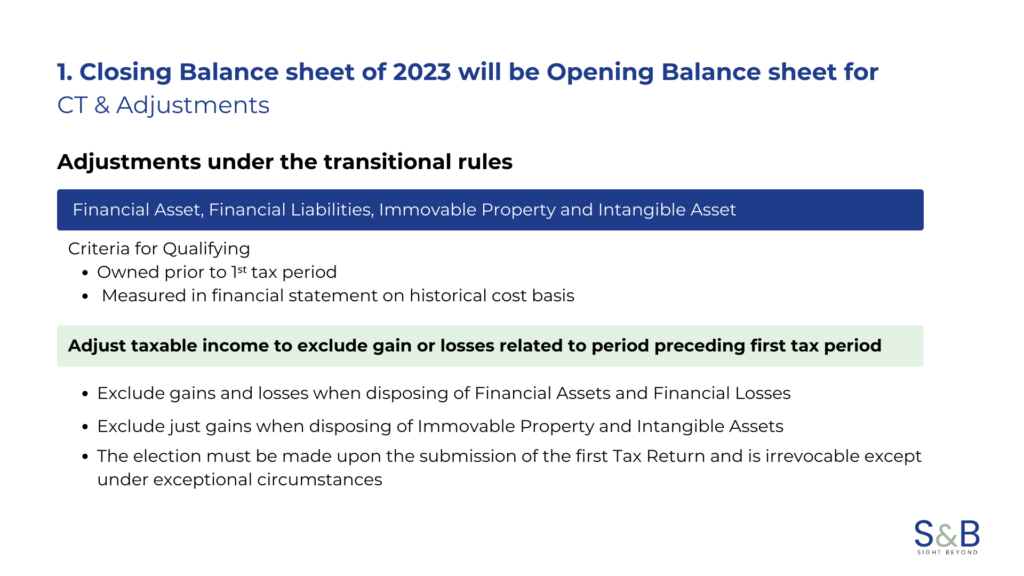

Criteria for Qualifying Assets

The definition of “qualifying assets” under the corporate tax transition rules is particularly important. In general, assets owned before the first tax period (2023) will be eligible for favorable treatment, as long as they meet certain criteria.

Businesses must use the historical cost basis when preparing their financial statements for these assets. This means that the value of an asset, for tax purposes, is determined based on its acquisition cost (adjusted for any applicable depreciation) rather than its market value or other methods of valuation.

Adjustments Under Transition Rules

The transition rules specifically exclude gains or losses that occur during periods prior to the first tax period. This is crucial for businesses as it means that any income or capital gains recognized in 2023 (before the tax regime takes effect) will not be subject to the new corporate tax rules.

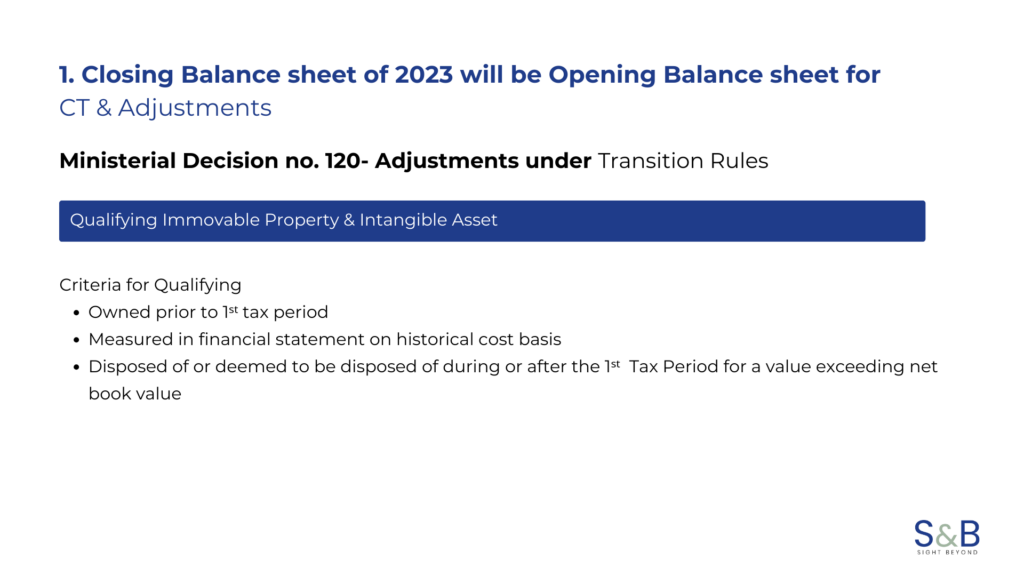

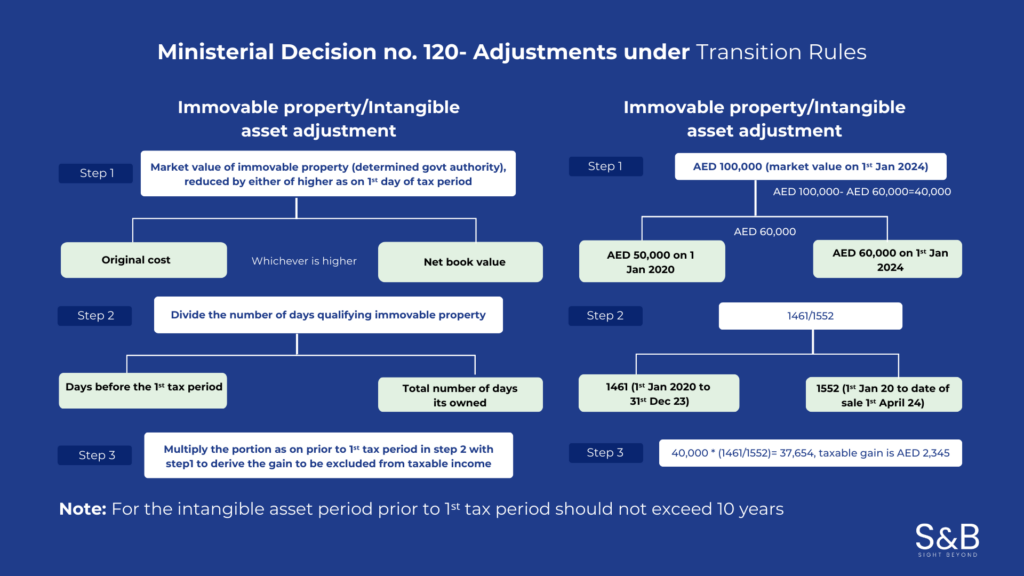

For certain types of assets, such as immovable properties and intangible assets, there are additional specific adjustments. For example, businesses may need to reassess the depreciable value of real estate or intellectual property under the new tax framework.

A key reference in this process is Ministerial Decision No. 120, which offers detailed guidance on the treatment of specific assets under the transition rules. This decision provides further clarity on how businesses should manage asset transfers, revaluations, and adjustments during the transition period.

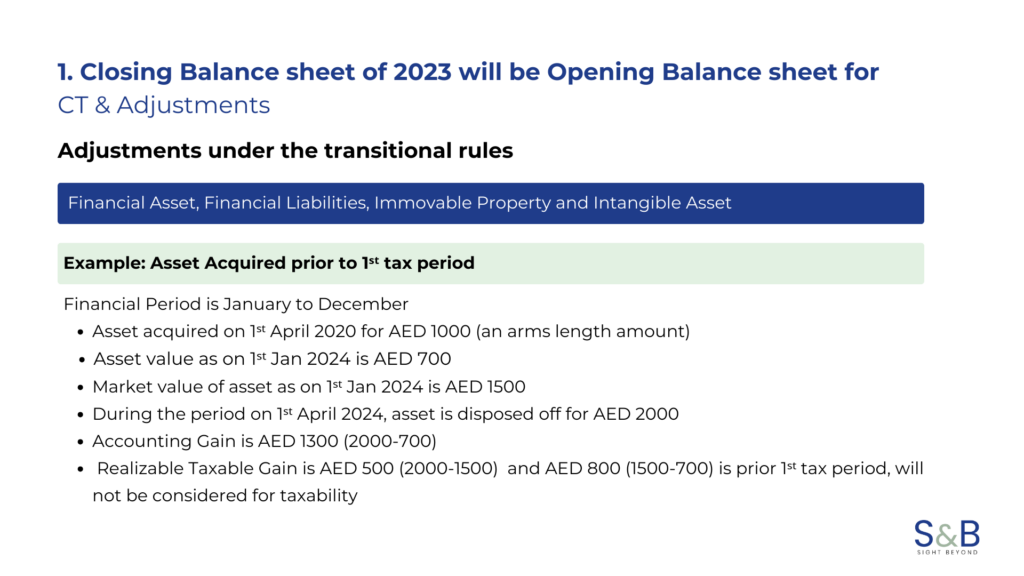

Case Study: Asset Disposal

To better illustrate how these provisions work in practice, consider the following simplified example of asset disposal:

Scenario: A company disposes of an immovable property that was owned before the first tax period (2023). The historical cost of the property was AED 1 million, and the market value at the time of disposal is AED 1.5 million.

Taxable Gain Calculation:

- The taxable gain would not be based on the AED 1.5 million market value, but rather on the historical cost basis of AED 1 million (minus any accumulated depreciation).

- The difference between the selling price and the historical cost (after adjustments) will be considered the taxable gain.

This example helps clarify that the transition provisions exclude any market-based gains or losses from prior periods, and the tax treatment is linked to the original cost basis of the asset.

Conclusion

The UAE’s Corporate Tax Transition Provisions are designed to help businesses navigate the shift to the new tax system with greater ease. However, navigating these provisions can be complex, especially when determining qualifying assets, making adjustments to opening balances, or applying anti-abuse rules. Ensuring compliance is not only essential for avoiding penalties, but also for optimizing tax positions moving forward.

Given the complexity of these rules and the evolving nature of corporate tax regulations, businesses are strongly encouraged to seek expert guidance to ensure smooth and compliant transitions.

At S&B Consulting, we specialize in providing businesses with tailored tax solutions, helping you effectively manage your tax obligations under the new corporate tax regime. Our team of experts can guide you through the transition provisions, assist with asset revaluation, and ensure you remain compliant with all requirements.

Contact us today for personalized advice on how the UAE corporate tax transition provisions impact your business, and how we can help you optimize your tax strategy.