We recently concluded our comprehensive webinar on the UAE’s e-invoicing mandate, designed to help businesses understand the key aspects of this initiative by the Ministry of Finance. Here’s your insider view of the key takeaways:

Introduction to E-Invoicing

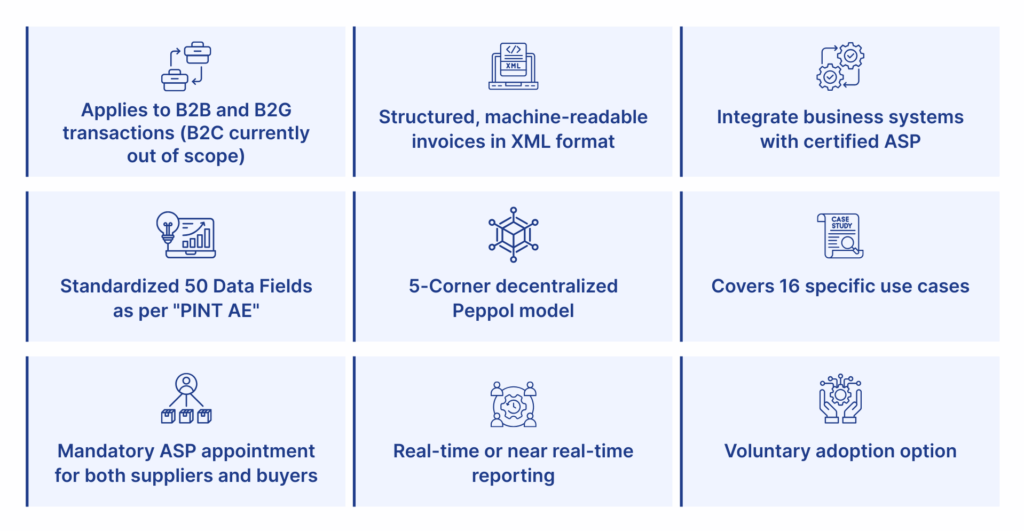

E-invoicing is a government-mandated initiative introduced by the UAE Ministry of Finance (MoF), requiring UAE businesses to generate, issue, and store invoices electronically in a structured format. Invoices are exchanged digitally between the seller’s and buyer’s systems, and tax data is recorded by the Federal Tax Authority (FTA) in real-time.

This initiative is part of “We the UAE 2031” Vision, aimed at strengthening digital infrastructure, reducing human intervention, improving taxpayer experience, reducing the tax gap, enabling data analytics, and supporting sustainability goals through reduced paper usage.

The UAE e-invoicing framework follows a decentralized five-corner model built on the Peppol network, enabling secure, interoperable, and seamless exchange of e-invoices between businesses through Accredited Service Providers (ASP). To comply, businesses must integrate their ERP or accounting systems with an ASP to ensure real-time reporting, improve accuracy, and reduce errors.

This is a crucial time for businesses to review and align their existing processes and IT systems with the upcoming e-invoicing mandate. Organizations must seize this opportunity to upskill their teams and strengthen digital compliance capabilities — ensuring full alignment with MoF requirements, avoiding penalties, and staying future-ready in the evolving tax landscape.

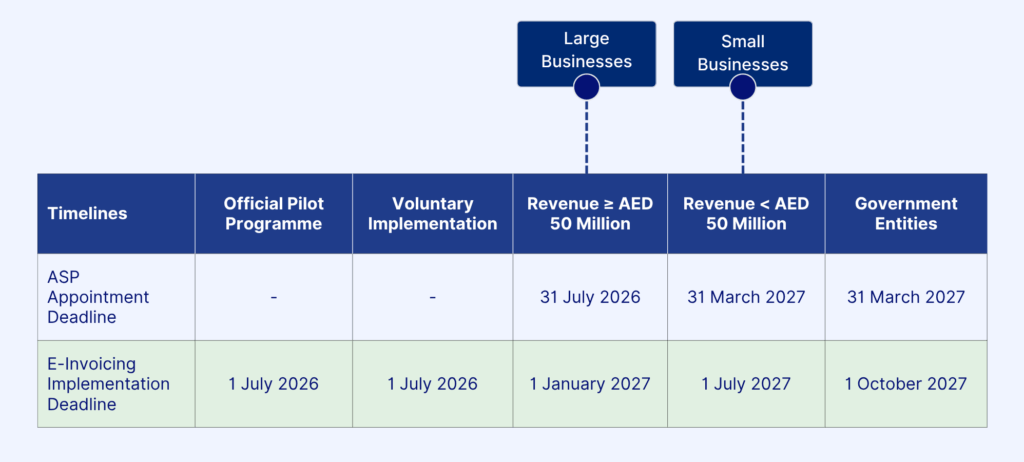

Implementation Timeline

The UAE e-invoicing rollout will be implemented in phases, starting with pilot and voluntary programs on July 1, 2026. The implementation will initially focus on larger businesses from 1 January 2027 and will gradually extend to smaller entities by 1 July 2027. The applicability for government entities is expected to begin on 1 October 2027.

Pilot & Voluntary Programs

- Pilot Program: MoF/FTA invites businesses to join a Taxpayer Working Group to test systems and processes early, identify issues, and prepare for the mandatory rollout.

- Voluntary Program: Additionally, businesses are recommended to participate in the early adoption program to streamline processes, reduce errors, and gain practical experience with the Peppol model without any penal implications.

Core Elements of the E-Invoicing Framework

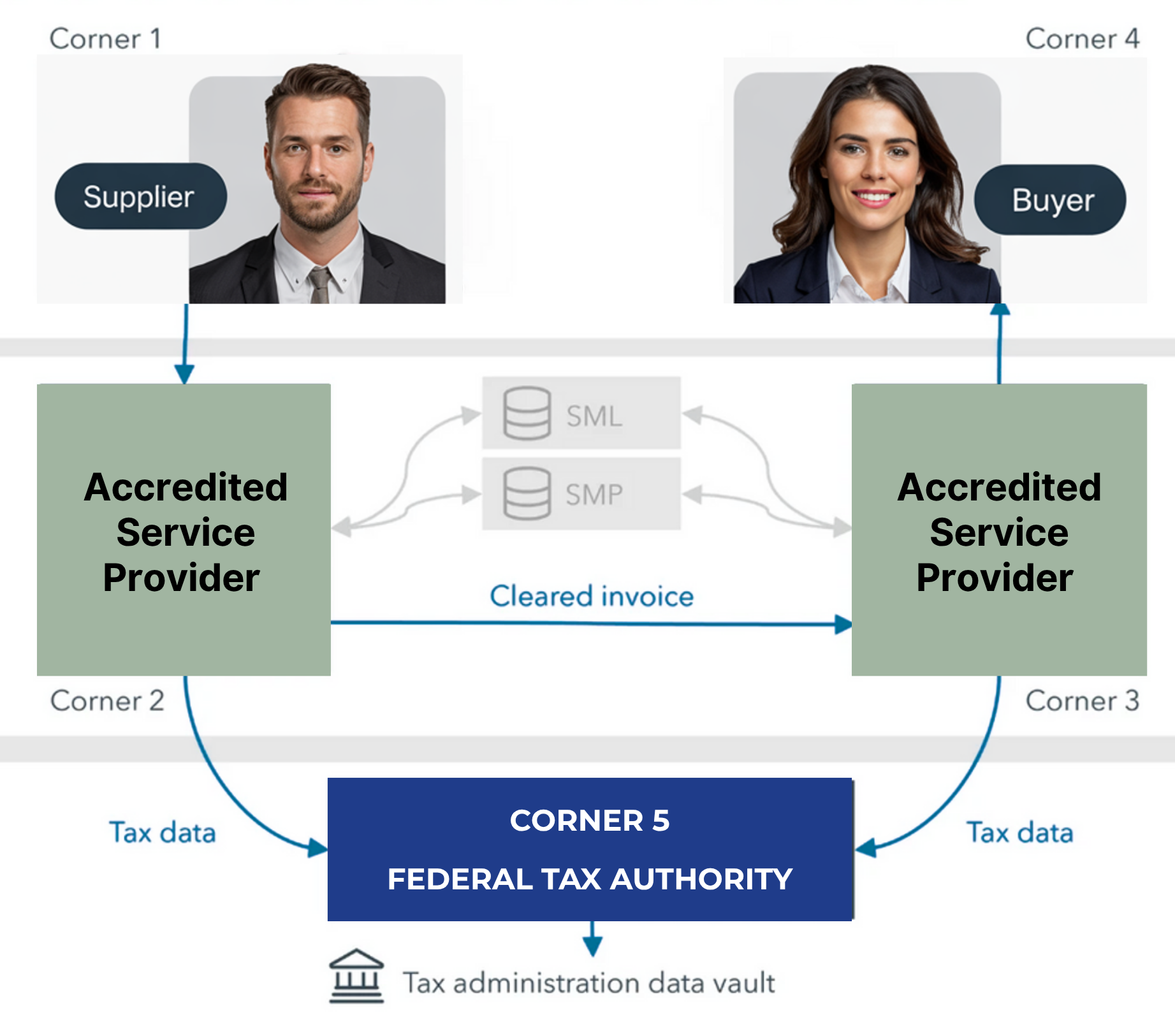

The UAE’s 5 Corner Model

The UAE uses a unique 5-corner decentralized model, connecting businesses to the system through Authorized Service Providers (ASPs) via a secure, interoperable Peppol network, which enables real-time or near real-time invoice flow.

| Corner | Entity | Key Function / Role |

| Corner 1 | Supplier (Seller) | Creates the e-invoice in a structured format and sends it through its integrated ASP. |

| Corner 2 | Supplier’s ASP | Validates the e-invoice format to be in compliance with MoF standards, applies digital signatures, and transmits it securely through the peppol network. |

| Corner 3 | Buyer’s ASP | Receives the e-invoice, validates integrity and authenticity, and delivers it to the buyer’s accounting or ERP system. |

| Corner 4 | Buyer (Recipient) | Reviews, acknowledges, and processes the e-invoice for payment. |

| Corner 5 | UAE MoF/ FTA | Receive the Tax data from corner 2 and corner 3 in Tax data Repository (TDR) |

Unlike centralized models, the UAE has adopted a decentralized approach, where the FTA receives tax data but does not directly process or clear invoices, unlike the clearance models used in other countries. ensures flexibility, data privacy, and scalability, while maintaining integrity and auditability.

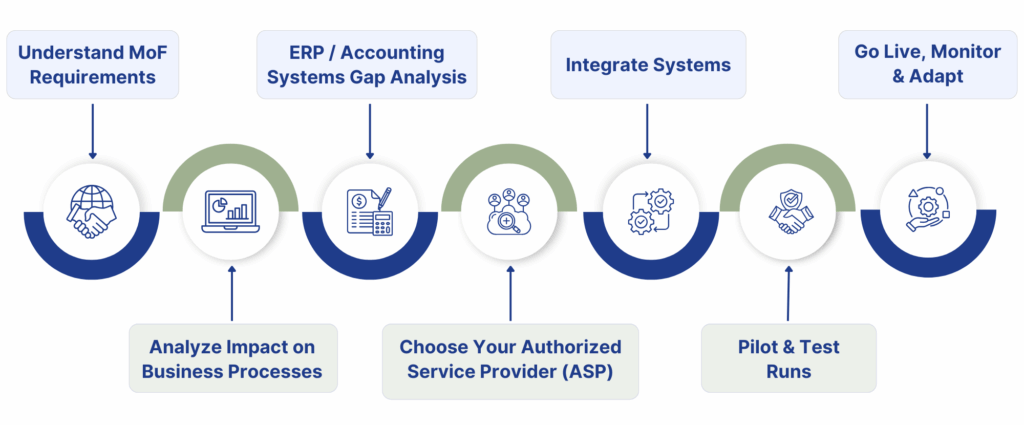

Your Next Steps Toward E-Invoicing Readiness

Businesses must start preparing early for the e-invoicing mandate. The expert team at S&B Consulting can provide step-by-step support throughout your e-invoicing journey:

1. Understand MoF Requirements:

Familiarize your business with all UAE MoF e-invoicing guidelines, including the types of invoices covered, required data fields, and reporting obligations. Understand the mandatory deadlines, phased implementation schedules, and any applicable exemptions.

2. Analyze Impact on Business Processes:

Review and map how e-invoicing will affect your existing workflows, including invoice creation, approvals, validation, posting to accounting, and reporting. Identify changes required in roles, responsibilities, and approval hierarchies to ensure smooth integration with MoF and ASP requirements. Assess dependencies across departments such as procurement, sales, and finance to avoid disruptions.

3. ERP / Accounting Systems Gap Analysis:

Conduct a thorough review of your ERP, accounting, and invoicing systems to ensure they can generate, transmit, and store structured e-invoices in the format required by the MoF. Identify missing functionalities such as integration with ASPs, real-time reporting, automated validations, TDR recording, and audit trail capabilities. Highlight areas where software upgrades, customizations, or additional tools may be required for full compliance and seamless operations.

4. Choose Your Authorized Service Provider (ASP):

Evaluate and select an ASP based on key criteria such as compliance readiness, data security, interoperability, and technical capabilities.

5. Integrate Systems:

Connect your ERP, accounting, or invoicing system with the chosen ASP to enable automatic generation, validation, and transmission of structured e-invoices. Ensure that integration supports real-time reporting, error handling, digital signatures, and TDR compliance.

6. Pilot & Test Runs:

Conduct comprehensive pilot testing with sample invoices to validate system functionality, invoice accuracy, compliance with MoF data requirements, and seamless interaction with your ASP. Identify and resolve technical issues, workflow bottlenecks, or data mismatches. Use the pilot phase to train staff and refine internal processes for full-scale implementation.

7. Go Live, Monitor & Adapt:

Begin officially issuing and transmitting e-invoices. Continuously monitor performance, stay updated with MoF/FTA announcements, and adapt your systems and processes to ensure ongoing compliance.

How S&B Consulting Supports Your E-Invoicing Journey?

Our expert team at S&B Consulting supports businesses step-by-step in their e-invoicing journey from understanding MoF requirements tailored to the business, to business process impact analysis, ERP/accounting systems gap assessment, system integration, ASP selection*, pilot testing, and full rollout. We help ensure compliance, operational efficiency, and a seamless transition to the UAE’s new e-invoicing ecosystem.

S&B Consulting is already a registered member of Peppol and is currently in the process of obtaining accreditation from the UAE Ministry of Finance.

Want to learn more about UAE E-Invoicing?

For a deeper understanding of the UAE’s e-invoicing framework — including timelines, compliance steps, and expert insights — watch the full webinar here: